|

- Tradervision Signals Statistics from 1983 to date... An unique opportunity for your team to join us & provide your clients with +88% image winner-trades.

- Limited number of trades: the "Wall-street cardiographic" seems to be made of 6 expansions & 6 contractions within a year, on average. This slow breathing or slow heart-beating is the core of Tradervision and, again on average, generates 6 "buy-calls" and 6 "buy-puts" instructions within a year, to cash-in volatility. Obviously, consequences are important: no need to spend hours in front of your screen & a huge stress relief to practice our favorite but the cruelest game on earth.

- Limited risk: long calls & puts only.

- Limited funds: at the money,minimum 2 months to expiry date.

- Limited duration: from 2 to 4 Wall-street sessions.

- Limited satisfaction: so far, no better result than 88% winning trades.

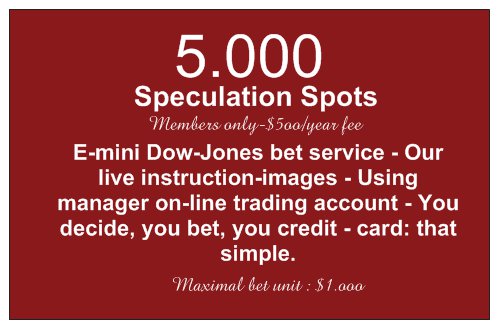

- Unlimited number of traders/investors ready to learn. Five (5) billion smartphone users & only one S&P 5oo/Dow Jones Speculation Smartphone Service.

- Unlimited potential profits within your reach: $5oo fee/signal/year mutiply by your customers/subscribers within your area. Fees are yours. Minus our $5oo.ooo ...

| GOOD |

WRONG |

TOTAL |

YEAR |

RETURN

ON INVEST (R.O.I.) |

| 11 |

01 |

12 |

1983 |

+76% |

| 09 |

01 |

10 |

1984 |

+518% |

| 12 |

03 |

15 |

1985 |

+646% |

| 19 |

02 |

21 |

1986 |

+482% |

| 08 |

01 |

09 |

1987 |

+43% |

| 06 |

02 |

08 |

1988 |

+83% |

| 11 |

02 |

13 |

1989 |

+158% |

| 09 |

01 |

10 |

1990 |

+138% |

| 11 |

02 |

13 |

1991 |

+156% |

| 08 |

02 |

10 |

1992 |

+138% |

| 08 |

01 |

09 |

1993 |

+146% |

| 08 |

00 |

08 |

1994 |

+178% |

| 07 |

02 |

09 |

1995 |

-86% |

| 09 |

00 |

09 |

1996 |

+253% |

| 08 |

02 |

10 |

1997 |

+191% |

| 12 |

01 |

13 |

1998 |

+208% |

| 08 |

01 |

09 |

1999 |

+124% |

| 11 |

04 |

15 |

2000 |

+207% |

| 09 |

01 |

10 |

2001 |

+109% |

| 10 |

02 |

12 |

2002 |

+208.66% |

| 09 |

02 |

11 |

2003 |

+138.38% |

| 06 |

02 |

08 |

2004 |

+50.13% |

| 12 |

01 |

13 |

2005 |

+201% |

| 08 |

02 |

10 |

2006 |

+192.09% |

| 05 |

00 |

05 |

2007 |

+103.56% |

| 10 |

00 |

10 |

2008 |

+171.45% |

| 12 |

01 |

13 |

2009 |

+124.74% |

| 11 |

01 |

12 |

2010 |

+148% |

| 10 |

00 |

10 |

2011 |

+156.51% |

| 10 |

02 |

12 |

2012 |

+105.17% |

| 09 |

02 |

11 |

2013 |

+168.87% |

| 10 |

00 |

10 |

2014 |

+92.37% |

| 10 |

00 |

10 |

2015 |

+240.55% |

| 08 |

01 |

09 |

2016 |

+79.41% |

| 08 |

00 |

08 |

2017 |

+44.54% |

| 12 |

02 |

14 |

2018 |

+145.13% |

| WINNING PROBABILITY HISTORY |

| GOOD : 399 |

WRONG : 51 |

TOTAL : 450 |

| +88.67 % |

How to calculate Tradervision's performance?

Performance: +198% (as of Nov. 10,2000)

- Total premium paid: $776.250

- Total signals: 14

- Premium / Signals ratio: $55.660

- Total gains: $127.405

- Total losses: $17.300

- Balance: $110.105

Generated profits / Per signal average investment: $110.105 : $55.660 = 198%

Open your account and follow the Tradervision's instructions.

|